In South Asia, Bangladesh’s textile industry is a booming part of the economy and culture. The story of Bangladesh’s textile industry is about overcoming difficulties with resilience. The WTO estimates that Bangladesh has contributed 45 billion worth of apparel to the global market. Millions of unemployed people now have the chance to find work especially the uneducated women. Bangladesh exports 35 different kinds of clothing items to roughly 31 different nations worldwide. But behind the top of this booming it has a complex web of issues that present vast obstacles to its continued expansion. This article discusses the numerous difficulties, revealing the details that affect its current and future state.

Misconception in Green Industry: The textile industry faces the challenge of transitioning towards greener practices .Despite several obstacles, Bangladeshi textile entrepreneurs have accepted the “Go Green” concept as a role model. One major challenge is shortage of green financing, which limits companies’ ability to invest in sustainable practices . The consumer does not provide us a price advantage, but the buyer does give us order priority. A green factory will cost 25-30% more than a standard factory. Bangladesh has 157 certified green apparel factories. Regarding this figure, is the Green factory profitable ? Should we think about this sustainable investment either for money or for world’s betterment?

Financial Barriers:

Financial limitations, such as LC and dollar shortages, present challenges for businesses, like VAT and TK inflation. Before 2020, textile import taxes were between 12% to 18%.

After 2022, tax rates were raised to a maximum of 50%. Taxation can be a key barrier to Bangladesh’s textile . High taxes can boost overall production costs, reducing the prices of Bangladeshi products on the global market.

Furthermore, as textile millers battle with the collision of the current financial crisis, the Letter of Credit (LC) limit is rising. On the other hand, due to the current global economic situation, the Bangladesh government raised the interest rate by 2%, making the situation more challenging.

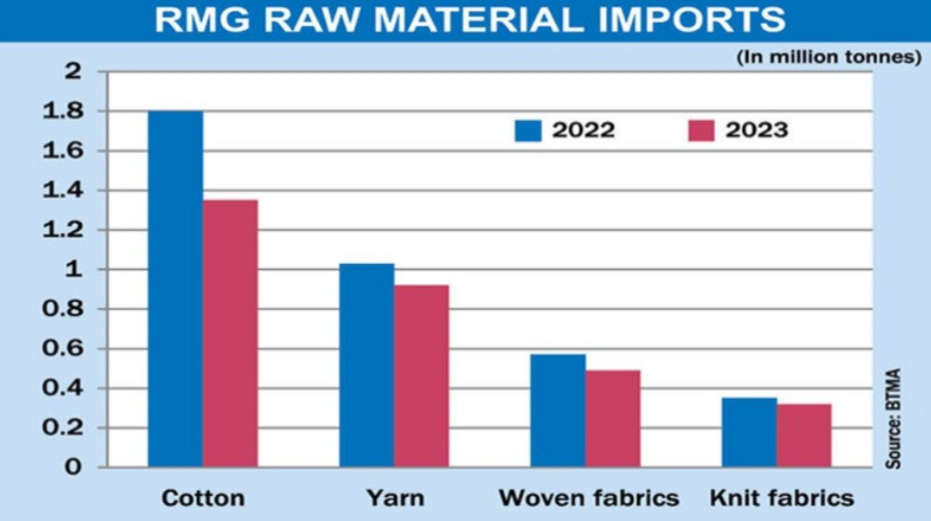

Insufficient Raw Materials:

Cotton, polyester, synthetics, nylon, and all chemicals are limited and must be imported from China and India. China supplies roughly 15 to 20% of raw materials, as well as 80 to 85 percent of dyeing chemicals and accessories for the knitwear sector. Raw material import expenses were $4,984.13 million in the same time last year, which is 48.51% of total RMG export income. As a result, production costs are rising, but buyers are unwilling to pay huge amounts; resulting in difficult-to-recover losses.

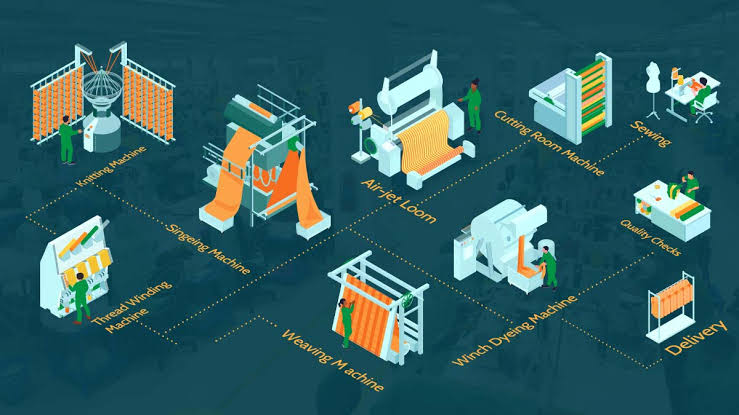

Lack of Technology-Oriented Workers:

Labor-intensive technologies are largely used in Bangladesh’s garment industries. Thanks to technology, competitors are producing more high-quality, value-added products with higher efficiency. Even though 4.0 technology powers the global industry, most of us are still in the 2.5 or 3.0 level. In five to six minutes, China’s fully automated machinery can sew a pair of jeans. Surprisingly, we take 15 to 20 minutes to complete.

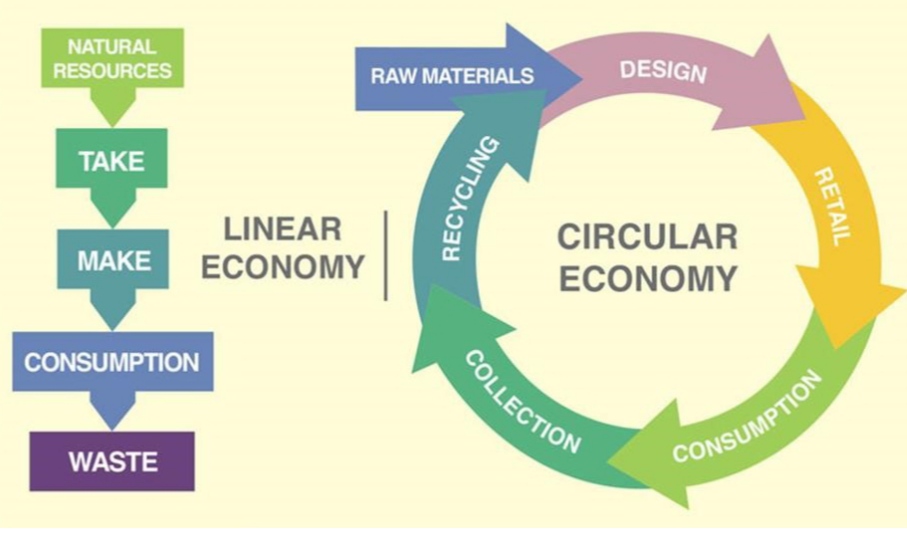

Circular Economy:

For Bangladesh, implementing a circular economy in the textile sector presents both potential and difficulties. With insufficient investment in recycling facilities, infrastructure and technology, research and innovation, textile industry in Bangladesh cannot keep sustaining. Bangladesh is a great location for organized progress in waste segregation because it is a key supplier of the commodity and has many established commercial relationships there. Exporting clothing created from recycled yarn and fabric might bring in $6–7 billion if textile waste is fully exploited.

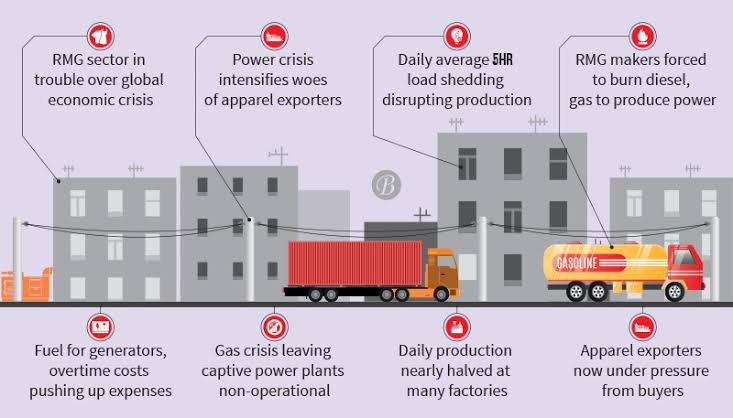

Global Competitors: The Bangladeshi garment industry has strong competition around the world. Vietnam beat Bangladesh in the textile and apparel industry in 2020.Because Vietnam’s factories continued to operate despite the pandemic, whereas Bangladesh’s textile businesses were closed. Moreover, Vietnam has a better geographic location and more structured seaports, Vietnam can complete orders in one-third of the time Bangladesh takes. Due to rising oil prices caused by the RussiaUkraine war, Bangladesh had to pay more on raw material imports. We still don’t have enough fresh orders after the epidemic dismissed orders totalling 2.8 billion dollars.

Insufficient Energy Supplies: Lack of gas and electricity is causing major issues for Bangladesh’s textile sector. The cost of operating industries with diesel generators is high, and the energy crisis is driving up additional expenses that are limiting exports. According to Export Promotion Bureau figures, September exports decreased by 6.25% to $3.9 billion from $4.16 billion in August of last year due to delays in production caused by low gas pressure. The RMG sector holds a unique position in the Bangladeshi economy since it is the country’s largest exporter. Over the past 25 years, it has grown astronomically. Bangladesh may look forward to the future thanks to its workforce’s commitment and exceptional innovation.

Possibilities are accompanied by problems. We must try to conquer our obstacles in the upcoming year. We need to use cutting-edge technologies to create value-added products. And the textile sector can only do this when it employs skilled individuals. We believe that we can improve our economy if our textile engineering society steps up to overcome such issues.

Writer Information:

Name : S.M.Wahid Mashrafi

Department : Yarn Engineering

University : Bangladesh University of Textiles